When you run a small business, it is a legal requirement to keep proper books and records for tax purposes. You have better things to do than try and understand the complexities of the UK tax system, which is why we put this guide together on ASDA VAT receipt.

If you have ever been left scratching your head about how to find VAT on an ASDA receipt, what the codes are, and how to properly account for them, this will explain it all.

Where is the VAT number on an ASDA receipt?

Just because VAT is not clearly detailed on the receipt does not mean there is no VAT on an ASDA receipt. ASDA are VAT registered and if you have bought items that are vatable you will have VAT to reclaim but ASDA does not make it easy to find the answer. ASDA Stores Limited VAT number is GB 362 0127 92 displayed on the bottom of a VAT receipt.

There are different rates of VAT applied to the items you would purchase from ASDA and it is made harder by not splitting out the VAT in an obvious way. You see for receipts under £250 including VAT retailers like ASDA can apply different rules.

Can you get a VAT receipt from ASDA?

There’s no requirement to issue a VAT invoice for retail supplies to unregistered businesses. As a retailer, ASDA may assume that no VAT invoice is required unless the customer asks for one on groceries or petrol.

But ASDA do give VAT receipts if you ask for one. ASDA VAT receipts for groceries are available in-store. All you need to do is drop in and ask at the Customer Service Desk where a VAT receipt can be issued. A VAT receipt can also be issued at the kiosk in one of our smaller local or convenience stores.

If asked for an invoice, then ASDA has the following options.

If the charge made for the individual supply is:

- £250 or less (including VAT), then they can issue an invoice showing your name, address and VAT registration number, the time of supply (tax point), a description which identifies the goods or services supplied, and for each VAT rate applicable, the total amount payable, including VAT shown in sterling and the VAT rate charged – exempt supplies must not be included in this type of VAT invoice

- more than £250 and they are asked for a VAT invoice, then they must issue either a full VAT invoice or modified VAT invoice, showing VAT inclusive rather than VAT exclusive values

Details required on a full VAT invoice

You must show the following details on any VAT invoices you issue:

- a sequential number based on one or more series which uniquely identifies the document

- the time of the supply

- the date of issue of the document (where different to the time of supply)

- the name, address, and VAT registration number of the supplier

- the name and address of the person to whom the goods or services are supplied

- a description sufficient to identify the goods or services supplied

- for each description, the quantity of the goods or the extent of the services, and the rate of VAT and the amount payable, excluding VAT, expressed in any currency

- the gross total amount payable, excluding VAT, expressed in any currency

- the rate of any cash discount offered

- the total amount of VAT chargeable, expressed in sterling

- the unit price

- the reason for any zero rate or exemption

Handy Hint: Read our guide to how you can claim back VAT on parking charges.

What is a VAT invoice or receipt?

A VAT invoice is just the term for an invoice which contains some information required by the VAT rules. Most commercial invoices will already meet the requirements.

Only VAT-registered businesses can issue VAT invoices and if you’re VAT-registered, you must issue a VAT invoice whenever you supply standard rate or reduced rate goods or services to another VAT-registered person. Normally you must issue a VAT invoice within 30 days of the date you make the supply.

How to work out VAT on ASDA receipt?

As we have identified above if a retailer such as ASDA completes a single supply of less than £250 including VAT, they can provide a VAT receipt that shows for each VAT rate applicable, the total amount payable, including VAT shown in sterling and the VAT rate charged – exempt supplies must not be included in this type of VAT invoice.

That means you will see a total on the receipt for the totals of each VAT rate not necessarily against each item. To work that out if perhaps you are splitting out the costs between different account codes in your bookkeeping software you will need to know how to work out the VAT on ASDA receipt.

What do the VAT letters mean on an ASDA receipt?

You can work out VAT on an ASDA receipt, but you need to know what the Asda VAT receipt codes relate to.

Asda VAT receipt codes

- D = VAT not payable (groceries, fresh foods, children’s clothes) – these are your zero-rated purchases

- V = VAT payable at the standard rate of VAT

- M = VAT payable at the standard rate of VAT

- No indicator shown = VAT not payable (postage, stamps, lottery) – these are your exempt rated purchases

Why does ASDA have two standard-rated VAT codes? These are used for internal reporting as M covers items sold from the kiosk/tobacco.

Each item charged at the standard rate of VAT has a V at the end of each row after the amount is displayed.

The line-item amount is inclusive of VAT so if you purchased an item with an A after it for £1.20 inclusive of VAT it would be £1.00 plus £0.20 of VAT to reclaim.

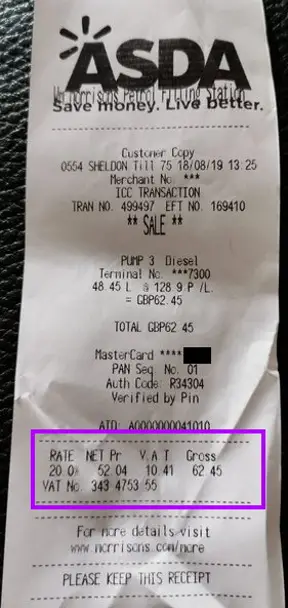

The ASDA VAT receipt explained

In the VAT Receipt Summary, you would see a total for all zero-rated purchases and a separate line for the standard-rated items. This will display the net tax amount and then the total VAT.

Using the letter codes (ASDA VAT receipt codes) you will then be able to work out which items on your ASDA receipt have VAT.

Can I get a VAT receipt for ASDA home delivery service?

If you run a business there may be occasions when you use a service such as ASDA home delivery, for example, cleaning materials for the office.

But can you get a VAT receipt for ASDA home delivery? As you may have experienced you do not automatically get a valid VAT receipt as the home delivery service is a domestic service even though you may be using it for business purposes.

If you would like a VAT receipt for your online grocery order, please email ASDA to make your request. This can take up to 30 days.

Do supermarket receipts show VAT?

Supermarket receipts do not always show VAT. Unless you ask for a VAT receipt you may end up with just the payment slip displaying the items purchased and the payment details, but no VAT number or breakdown of the VAT charged.

There’s no requirement to issue a VAT invoice for retail supplies to unregistered businesses. Unless you make a request for a VAT receipt you may not hold a valid VAT receipt and cannot, therefore, claim back VAT incurred on expenses.

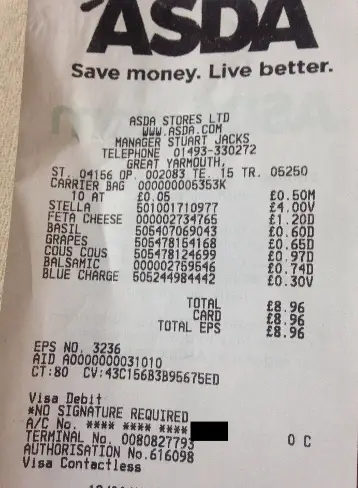

See the example below which is not a valid VAT receipt. It does not have a VAT number, it does not display a record of the VAT that has been charged or the applicable tax rate.

Not claiming VAT on business expenses can impact the cash you have in your business and the amount of money you have available to pay yourself through profits.

On the receipt above we can see a letter code after the name of the purchased item. This would indicate the rate of that VAT applies but without a valid VAT receipt should we reclaim it?

If you are VAT registered, you may still claim VAT on business expenses without a receipt if the purchase is below £25. We would always recommend getting a receipt where possible as evidence.

Consider this simple example of claiming missed VAT:

- Purchases in the year: £12,000

- VAT: £2,000

- Cost to business: £10,000

- Additional Cash: £2,000

- Additional Profit: £2,000

Getting this wrong can add up to a sizeable amount of money across the financial year. It is always best to double-check receipts (always keep them) and invoices for evidence of VAT applied to postage.

Can I claim VAT from the supermarket?

You can claim VAT from a supermarket for a valid business expense where the supermarket is registered for VAT. A supermarket VAT receipt will need to include a VAT number.

Only VAT-registered businesses can issue VAT invoices and if you’re VAT-registered, you must issue a VAT invoice whenever you supply standard rate or reduced rate goods or services to another VAT-registered person. Normally you must issue a VAT invoice within 30 days of the date you make the supply.

You may need to request a VAT receipt from the supermarket if they have not provided one. This will then provide the correct information on which you can claim VAT from the supermarket purchase.

Handy Hint: You might also find our guide to Morrisons VAT receipts helpful for business expenses.

Lost receipts for supermarket expenses

Don’t worry if you have lost a receipt for supermarket expenses, it is not the end of the world. These things happen. In fact, 65% of Senior Decision-makers in finance and accounting admit to losing receipts.

Try to get copies of as many as you can, for example, ask supermarkets for duplicate invoices or receipts (if you have the payment slip this may contain a reference number). Using your business bank account for making purchases will help with this as you will have an audit trail of what was spent and when.

You may have to pay interest and penalties if your figures turn out to be wrong and you have not paid enough tax.

If you are making a claim for expenses from an employer, you may find them less forgiving. It is not uncommon for a business’s travel and expenses policy to state that no reimbursement will be made without a valid receipt.

FAQs on VAT receipts

How much business expenses can I claim without receipts?

In the UK there is no rule on the amount you can claim without a receipt. Sometimes you may make a business purchase without a receipt.

To claim these purchases as a business expense, pay for them from your business account, and keep a record of what was purchased, when and why.

Too many expenses claimed without evidence of receipts would be a red flag if HMRC wished to check your records.

If you are VAT registered, you may still claim VAT on business expenses without a receipt if the purchase is below £25. We would always recommend getting a receipt where possible as evidence.

Do I need to keep all receipts for business?

You need to keep proper business records so you can:

- Work out your profit and loss for tax returns

- Show them to HMRC should you be asked

In the UK there is no rule on the amount you can claim without a receipt. If you are VAT registered, you may still claim VAT on business expenses without a receipt.

You may have to pay interest and penalties if your figures turn out to be wrong and you have not paid enough tax.

Conclusion

When it comes to whether you can claim VAT on ASDA receipts you need to pay attention to the type of document you have received from the cashier. Where possible always ask for a VAT receipt if the details are not clear on the receipt.

The document you are presented with could lead you to miss out on claiming back VAT for a legitimate business expense.

That is your tax-free money please make sure you follow this simple process to make sure you claim everything you are entitled to. Better in your pocket than the taxman.

More small business advice

Image of Asda store by https://www.geograph.org.uk/photo/3319012

Jon has been in business since 1999, and in that time worked with more than 300 small business clients. As well as being an accountant, he is also an early adopter of tech, and has helped small businesses to leverage the power of their computer systems by creating software to automate and simplify accounting tasks.