As a small business owner, it’s so important to know when your financial year-end is, as this is the cut-off point for calculating profit, taxes and hopefully dividends for the year. Knowing when your year-end is will help you time business decisions to maximise the reported performance of the business.

The timing of key business decisions can be critical, for example, if tax legislation is going to change it could be beneficial to bring forward or push out buying capital assets. A big sale or large purchase being made one day on either side of the year-end can have a big impact on the financial accounts filed and the timing of tax payments.

Knowing your year-end date is not the only consideration you should take into account when making business decisions, but it could sway your decision-making process.

How do you know when your year-end is? Your financial year-end will normally be the end of a calendar month. For a limited company, it will be the end of the calendar month in which the business was incorporated. Check Companies House for confirmation. For a sole trader, you can choose your year-end. Check previously filed tax returns to confirm this.

When is the financial year-end?

In the UK the financial year-end date is commonly referred to as the fiscal year-end or the tax year-end. The terms are interchangeable, and that period runs from 6th April to 5th April each year.

For the purposes of this article when we refer to the financial year-end we are talking about your business entity’s financial trading year and not the tax year-end date.

Tax year-end date

The tax year-end date is different to the business’s financial year-end.

The tax year starts on the 6th of April and ends on the 5th of April each year. The UK is unique in having a 5thApril tax year-end. The reasons for this unusual date runs back to the Middle Ages and it was amended to 5thApril in 1800.

Most other countries align their tax year with the calendar year. The Office of Tax Simplification has reported that a change to 31 March or 31 December would make more sense ahead of the Making Tax Digital for Income Tax.

Your financial year-end date might be the same period as the tax year-end if you have set your financial year-end date to be the same. This is more common with sole traders as you need only work to one set of dates each year, making it simpler.

If you are using bookkeeping software, it is worth considering how the reporting works as sometimes reports can only be run for calendar months which does not help you if your year-end runs to the 5th of April.

Handy Hint: Always keep any receipts that relate to business expenses.

Why change the financial year-end

There are various reasons to change the financial year-end and we will go into these in detail in just a moment but before we do it is important to think about how a change of financial year-end date can be viewed from an outside perspective.

According to Red Flag Alert, a business intelligence solution that provides real-time business data on 6.5 million businesses:

Accounting period end changes are a common precursor to administration, with many recent examples of companies changing their year ends – often by lengthening and shortening periods to avoid filing accounts – shortly before going into administration.

There are a host of other reasons why a company might change their financial year-end that should be a cause for concern – usually, it suggests that they are trying to buy some time before problems in the business are uncovered.

For example, if the company is due to be audited for the past financial year, management can try to delay this by lengthening the accounting period. This is usually an attempt to sort out issues that will be found during the audit.

Similarly, if the company has something to hide and a deal is about to be struck, extending the accounting period can hide this information from the other party. Again, as a creditor, this is something you need to monitor.

Sometimes the intentions can be less clear-cut. For example, a common reason for changing year-end is to improve cash flow by deferring corporation tax payments. This may be sensible financial management, or it may be a sign that the company is struggling and a warning of greater problems to come.”

However, there are a host of non-suspicious reasons why a company might change its accounting period:

- align accounting dates with other companies in the same group (parent companies or subsidiaries).

- move it to a quieter trading time of year to help with staff workloads.

- bring it in line with a recognised trading cycle or season in your industry.

- avoid all the big tax payments being made at the same time of the year improving cash flow at critical times of the year.

- for sole traders, to align it with the tax year-end and work to one set of dates each year.

Shorten year-end by 1 day

The tactic of shortening accounting periods by a day for limited companies to avoid filing results can be just as suspicious as the extending year ends.

When the accounting reference date is shortened the new deadline for filing the accounts at Companies House becomes the longer:

- 9 months from the new accounting reference date (for a private company).

- 3 months from the date of receipt of the form AA01 which is used to change the accounting reference date.

The main reason this tactic is deployed is to avoid a late filing penalty. The simple solution to this is to be more organised and get your accounts filed in a timely fashion. Don’t forget if you leave compiling your accounts until the last moment you also do not know how much your tax bill is until it is potentially too late to do anything about it.

A limited company can shorten the company’s financial year as many times as you like – the minimum period you can shorten it by is 1 day.

If you do this the rules allow you to make your accounts up to 7 days on either side of the accounting reference date. In effect, you can make the accounts up as usual so no overall impact on processing your records or accounting software.

Example

- Current year-end: 31st March

- Changed year-end: 30th March

If you were due to file your accounts on 31st December and filed, the AA01 on the 31st December you would now have until 31st March to file those accounts.

You can lengthen your company’s financial year:

- to a maximum of 18 months, or longer if your company’s in administration.

- once every 5 years.

You can only lengthen the financial year more often than every 5 years if:

- the company is in administration.

- you’re aligning dates with a subsidiary or parent company.

- you have special permission from Companies House.

Frequently asked questions on how you know when your year-end is

How do I know my year-end?

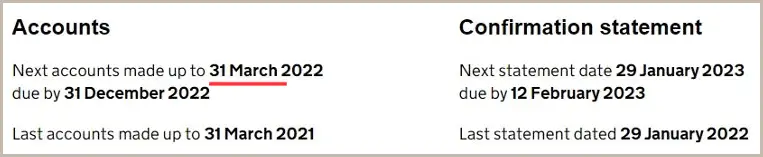

If you have a limited company this will normally be the end of the calendar month in which the business was incorporated unless you have changed your year-end.

To find your year-end and other useful information about your business in the public domain complete a search for it on Companies House using the link below.

We can see from the example below that the company’s year-end is 31 March, and they are due for filing by 31 December.

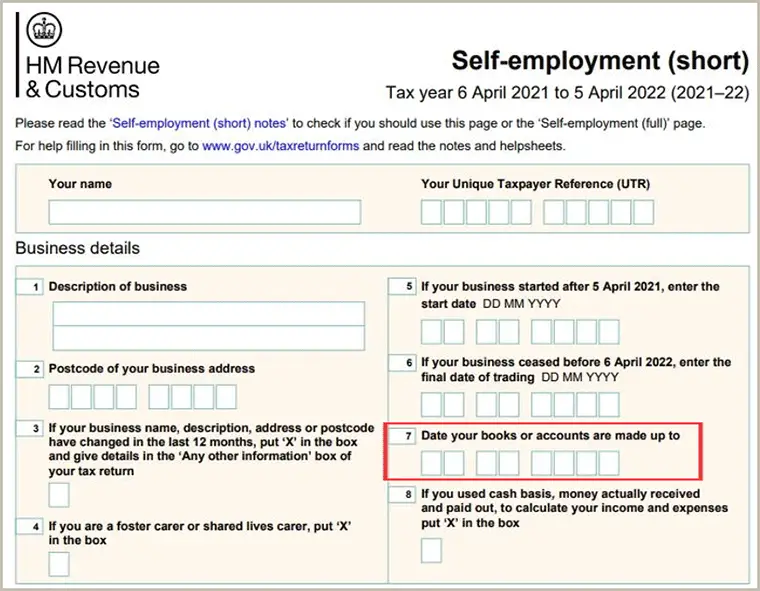

For a sole trade business, you would have set your year-end when completing your first set of accounts.

The easiest way to locate your year-end is to check your filed tax returns which will show the accounting period dates used for each trade if you have more than one.

What is the year-end process?

The year-end process will vary by business depending on the size and complexity of the entity. In general, for most, it will mean checking that all sales, purchases and salaries have been posted in the accounting records.

That the bank accounts and supplier statements have been reconciled for missing or incorrect items.

The VAT returns have been prepared and submitted to HMRC and accounting adjustments such as depreciation, accruals, prepayments, and stock movements have been posted.

Only once all these items have been posted into the accounting ledgers and balance sheet reconciliations have been reviewed can you start to prepare the accounts and tax returns.

How long is the financial year-end?

In most businesses the financial year-end normally refers to the period in which the company accounts are being closed and prepared ready for the year-end accounts to be ready for publication.

The length of that process can vary depending on the size and complexity of the business.

A schedule should be completed so those working in finance and business stakeholders such as the board can plan effectively.

Conclusion

Knowing when your year-end is vital for making sensible business decisions but also important for tax planning considerations.

Your year-end is not set in stone and can be amended which can lead to various options around how your business and tax affairs are structured and the timing of when tax payments need to be made.

Used to good effect your year-end can be a good tool in your business armoury if used well and the rules are understood.

Moving your year-end may be very beneficial from a cash flow point of view if you have all your big payments like corporation tax, VAT and self-assessment due around the same time.

You might also like…

Image in header via https://pixabay.com/photos/calendar-pay-number-year-date-2428560/

Jon has been in business since 1999, and in that time worked with more than 300 small business clients. As well as being an accountant, he is also an early adopter of tech, and has helped small businesses to leverage the power of their computer systems by creating software to automate and simplify accounting tasks.