Running a small business is a lot more complex than most would want to acknowledge. There are many rules and regulations (not to mention exceptions to the rules) that you as a small business owner are supposed to know. Ignorance is not a form of defence when it comes to HMRC.

This is particularly relevant when you start keeping books for a small business (or not, as the case might be).

You didn’t set up a business to become a bookkeeper or accountant, but this is where you can end up very quickly if don’t know how to keep books for a small business, or don’t use somebody who does.

Whilst there is a cost to paying an external resource such as a bookkeeper or accountant to manage your small business’ books, there is also a cost to doing it yourself. It’s the hidden cost of your time. According to a report from Starling, the average small business spends 15 hours per week or 19% of their time doing financial admin tasks such as their books.

However, if you do want to know how to keep books for a small business, and we recommend you do have an understanding, here’s our guide with a short intro first.

You can keep books for a small business by being organised and methodical. Choose an accounting method, use separate bank accounts, and keep records of every payment and receipt are just a few of the basics. The art of bookkeeping is simple, but it is not easy unless you possess these skills.

You must keep accurate books for your small business, so you calculate your profit and therefore the amount of tax due. Whilst you do not have to submit the individual records to HMRC you will want to make sure you can prove you know how to keep books for a small business. Failing to do so could trigger an HMRC investigation.

Here’s what you need to know…

How to start keeping books for a small business

Bookkeeping is the process of recording and reporting financial information. It is imperative to get your bookkeeping right to ensure you are reporting the correct profit and loss, calculating taxes, and making sound business decisions based on accurate data.

When you get started in keeping books, here are 10 key things you should do.

- Choose an accounting method – as discussed above you need to consider whether the cash or traditional method of accounting is right for your small business considering all the factors.

- Set up a separate bank account – probably the single most important thing you can do. It is hard enough maintaining the business records let alone if you are mixing business and personal transactions.

- Know your filing deadlines – there are multiple filing and reporting deadlines across the year for small businesses, if you factor in VAT and PAYE you could have as many as 30 filing requirements to be compliant. You need to get very organised.

- Keep records of every payment and receipt – you need to keep a log of all sales invoices raised and all bills received and when they were paid, reconciled back to your business bank account so you can track at any given point what you are owed and what you owe so you can manage your business cash flow.

- Keep track of expenses – every time you spend money from your own personal accounts there is a chance you will forget to claim it. Don’t. If you spend £120 from your own account and forget about it, you have just lost £20 in VAT and £20 in income tax relief. Not to mention the fact that you would have paid tax and national insurance on that £120 before you received it. A forgetful memory can be a very costly thing.

- Access to online banking – you need to always have your finger on the pulse, and this means knowing what is coming in and out of your business bank account. Make sure you have access to online banking from day one.

- Raise sales invoices frequently – you will be amazed at just how many sales invoices don’t even get sent to a customer on account of the business owner being busy and forgetting. Do this exercise often. It will avoid forgetting, queries will be raised faster, you can act on non-payments faster and you will ultimately get cash into your account quicker.

- Choose suitable software – all the above sounds difficult and time-consuming. You would be right. The administration of a small business is disproportionate to the amount of time you spend doing your trade, but it is just as important. Make your life as simple as possible by getting the right piece of software for your small business. There are hundreds of solutions on the market so this can be quite tricky but worth it in the long run. Popular programs include Xero and QuickBooks.

- Produce monthly reports – you need to know who owes you money, who you owe money to, what the performance of the business is what financial position you are in. This is not possible unless you start keeping books for your small business.

- Set time aside – keeping books for a small business is a time-consuming process even with the latest software. You need to plan this work in your diary, so it is done on a regular basis. Trying to squeeze it in between everything else will lead to mistakes which will cost you money.

You must make sure your records are accurate. It’s one of the easy ways to keep books for a small business.

Handy Hint: Read our guide on what records do I need to keep for a small business to learn more.

How to do your own books if self-employed

Regardless of the type of business entity that you choose there are several basic steps that you will need to know if you are going to learn how to do your own books self-employed.

You do not need an accountant as a sole trader. You may want one to help you prepare your year-end accounts and tax filings. Depending on the size of your sole trader business you will have to:

- Produce accounts.

- Calculate capital allowances.

- Complete self-assessment tax return.

- Payroll.

- Bookkeeping.

- VAT returns.

These are all time-consuming and complex tasks if you choose to do your own books when self-employed. Bookkeeping alone covers raising sales invoices, processing purchases, paying suppliers, recording expenses and mileage claims, reconciling the bank accounts, VAT returns etc

What records you should keep

You’ll need to keep records of:

- All sales and income.

- All business expenses.

- VAT records if you’re registered for VAT.

- PAYE records if you employ people.

- Records about your personal income.

- Your grants, if you claimed through the Self-Employment Income Support Scheme – check how much you were paid if you made a claim.

Why you keep records

You do not need to send your records in when you submit your tax return but you need to keep them so you can:

- Work out your profit or loss for your tax return.

- Show them to HM Revenue and Customs (HMRC) if asked.

You must make sure your records are accurate.

Keep proof

Types of proof include:

- All receipts for goods and stock.

- Bank statements, chequebook stubs.

- Sales invoices, till rolls and bank slips.

Your business will have various running costs and expenses if you’re self-employed. You can deduct some of these costs to work out your taxable profit if they’re allowable expenses.

Example

Your turnover is £40,000, and you claim £10,000 in allowable expenses. You only pay tax on the remaining £30,000 – known as your taxable profit.

Allowable expenses do not include money taken from your business to pay for private purchases.

If you run your own limited company, you need to follow different rules. You can deduct any business costs from your profits before tax. You must report any item you make personal use of as a company benefit.

Costs you can claim as allowable expenses

- Office costs, for example, stationery or phone bills.

- Travel costs, for example, fuel, parking, bus, or train tickets.

- Clothing expenses, for example, uniforms.

- Staff costs, for example, salaries or subcontractor costs.

- Things you buy to sell on, for example, stock or raw materials.

- Financial costs, for example, insurance or bank charges.

- Costs of your business premises, for example, heating, lighting, business rates.

- Advertising or marketing, for example, website costs.

- Training courses related to your business, for example, refresher courses.

Handy Hint: You cannot claim expenses if you use your £1,000 tax-free ‘trading allowance.

Check out our guide on can a small business do their own taxes to find out more about the tax-free allowance.

Simplified expenses

You can avoid using complex calculations to work out your business expenses by using simplified expenses. Simplified expenses are flat rates that can be used for:

- Vehicles.

- Working from home.

- Living on your business premises.

Understanding how to keep your own books when self-employed is a lot more complex than you originally envisaged. We haven’t even got to the fun part yet which is how and where you are going to keep all of these records that you need to produce.

How to keep records

If you would like to create a set of accounts for your self-employed business and you are not using an accountant or software that can provide this information, then you may find this a little difficult.

But it is one of the most important things you need to do when learning how to keep books for a small business.

At the heart of preparing a set of accounts is great bookkeeping. To do this, you will need to be using some form of bookkeeping solution whether that be Excel or an online bookkeeping solution.

There are hundreds on the market including Xero and Quickbooks.

Most if not all these solutions will have a reporting functionality that should consist of a profit and loss report and a balance sheet report. These form the basis of any set of accounts and are great when you start keeping books for your small business.

Our advice would be to make sure that whatever bookkeeping solution you use that you check it also covers your reporting requirements and you are going to be able to produce a very simple set of accounts from a few key reports.

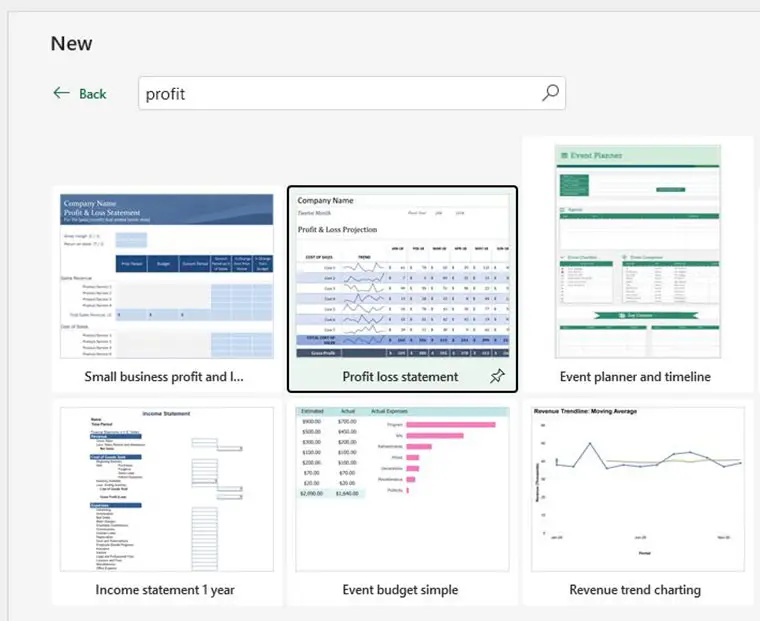

If you are going to use Excel to create your self-employed accounts template, then we would suggest using the templates that already exist. When creating a new document use the search templates function to find a host of business templates.

Perhaps you should be looking to work with an accountant. Check out our guide on how much does an accountant cost for small business to get an idea of costs.

Can I do my own accounts for a limited company

Accountants spend years learning their trade and become qualified professionals. To retain their professional qualification, they must also complete several hours Continued Professional Development (CPD) each year to ensure they are keeping up with the changing business and tax legislation.

Not having an accountant working with your business could mean you make mistakes which could cost you time and money which could have been avoided. There is a tendency when running a small business that you want to do things yourself such as tax and accounts to save money.

But what are the costs overall to your business of making mistakes?

A good accountant should be viewed as an investment to the business, not a cost. Any good accountant should save you more money than they cost even if that just equates to the time, they save you from doing things yourself.

Getting this wrong could trigger an HMRC investigation.

With over 11,500 pages of tax legislation governing the UK tax system and the Companies Act split into 47 Parts with the Contents page alone running to 59 pages that is why you need an accountant for your small limited company.

Can a small business do its own accounts? Yes.

Should a small business do its own accounts? No.

Handy Hint: Check out our guide is it a legal requirement to have an accountant for further support.

How to record sales for a small business

Making sure you get paid in a timely fashion for the goods and services you provide to customers is imperative if your business is going to survive. Poor cash flow is the number one reason of small business failure in the UK.

It is vital that you raise sales as soon as possible to ensure that any queries may be raised and resolved and to get paid as soon as possible.

Do not leave it until the end of the month when you have an admin day. You run the risk of forgetting the sale or simply waiting an extra 30 days before you get paid.

Remember the longer your sales invoice cycle, the bigger your business grows the larger your working capital cycle requirements will be putting pressure on you and your cash reserves.

Before we go into the details of how to record sales for a small business lets first discuss what you need to record.

You must show the following details on any invoices you issue:

- A sequential number based on one or more series which uniquely identifies the document.

- The time of the supply.

- The date of issue of the document (where different to the time of supply).

- The name, address, and VAT registration number of the supplier.

- The name and address of the person to whom the goods or services are supplied.

- A description sufficient to identify the goods or services supplied.

- for each description, the quantity of the goods or the extent of the services, and the rate of VAT and the amount payable, excluding VAT, expressed in any currency.

- The gross total amount payable, excluding VAT, expressed in any currency.

- The rate of any cash discount offered.

- The total amount of VAT chargeable, expressed in sterling.

- The unit price.

- The reason for any zero rate or exemption.

Items denoted in bold are what you are required to show on an invoice when you are non-VAT-registered and the items in black show the additional items that you are required to add when issuing a VAT sales invoice.

Special rules apply to invoices issued under a margin scheme or subject to a reverse charge. You need to follow the rules for such supplies.

If you decide that the bookkeeping has now become too complex for the average small business owner to handle then you could turn to an accountant or bookkeeper to help you create, post, and submit your VAT returns.

This will come at a cost so being VAT registered will ultimately end up costing your small business money in either your time or the cost of external support.

You need to weigh up the value of your time trying to learn new skills and continue to keep on top of legislative changes versus that of paying an expert in the field. If you conclude there is more value in doing it yourself, consider stopping your business and setting up a bookkeeping or accounting firm.

Bookkeeping is simple.

It’s just not easy.

If you decide that this is a job for you then we would advocate the use of an online bookkeeping software solution such as Xero or QuickBooks.

If you have a 4G enabled device, you can actually raise a sales invoice with the customer and have them pay it there and then by enabling payment via credit card or instant payment.

This will drastically reduce your administration, forgetting to raise an invoice and the potential of bad debts when customers do not pay. That happens a lot not to mention the time energy and effort you waste in chasing that money.

Using software will help you be compliant with how to record sales for a small business as they will have invoice templates that meet HMRC guidelines.

Each time you raise an invoice it will update your accounting records and VAT ledgers. You will be able to see from reports who owes you money immediately and some even come with built-in email reminders so you can automatically chase money owed to you.

All these things will save you time and money. Everything a small business needs.

Small business bookkeeping template

There are many bookkeeping templates readily available on the internet. We would suggest you look at your situation before deciding which one is right for you, or whether a bookkeeping template is the right option.

With the UK Government’s introduction of Making Tax Digital being introduced in the coming years, there is a drive towards the digitisation of accounting records. That is not to say that a spreadsheet template will not be good enough, but you will require some form of bridging software.

Now might just be the best time for you to investigate the software alternatives out there. These will provide a lot more functionality than a templated spreadsheet and will be Making Tax Digital compliant.

- Find software that’s compatible with Making Tax Digital for VAT

- Find software that’s compatible with Making Tax Digital for Income Tax

You can see that decision is already made twice as difficult if you are VAT registered as you will probably want to find something that works for both VAT and Income Tax as you will not want to be using two different solutions and potentially different costs.

If Making Tax Digital is of no concern or you will worry about it later then you could find a range of small business bookkeeping templates online. We have listed a few below for you that we have found useful.

- Business Accounting Basics has 21 free Excel small business bookkeeping templates.

- Beginner Bookkeeping has 18 free Excel small business bookkeeping templates.

- Excel Skills has this basic accounting template which great functionality at a cost of £40.

The fact that there are 21 different templates to use for a small business when completing their bookkeeping should be a clue to how much needs to be done. Think carefully about whether this is a challenge you wish to take on.

FAQs on how to keep books for a small business

How do I keep books when self-employed?

As a self-employed person you will need to keep the following records in relation to each sole trade you are operating:

- All sales and income.

- All business expenses.

- VAT records if you’re registered for VAT.

- PAYE records if you employ people.

- Records about your personal income.

- Your grants, if you claimed through the Self-Employment Income Support Scheme – check how much you were paid if you made a claim.

You will also need to keep any P60s in relation to any paid employment, and details of any other earned income that is neither employment income or sole trade income. If you have rental properties for example you will need to keep accounts of income and expenditure for them.

All these different income streams and any expenses will be needed for your self-assessment tax return.

You do not need to send your records to HMRC when submitting your tax return, HMRC does not know whether your claim is valid and is not checking each transaction. This can lead you to believe that what you are doing is fine. As such submitting information that looks odd could cause you an issue.

Handy Hint: Read our guide on what triggers an HMRC investigation for more information.

What kind of bookkeeping is used by a small business?

There are two main types of bookkeeping that are used by small business which are:

Most businesses use traditional accounting where you record income and expenses by the date you invoiced or were billed.

Example

You invoiced a customer on 28 March 2021. You record that invoice for the 2020 to 2021 tax year – even if you did not receive the money until the next tax year.

Most small businesses with an income of £150,000 or less can use cash basis reporting. With this method, you only record income or expenses when you receive money or pay a bill. This means you will not need to pay income tax on the money you have not yet received in your accounting period.

Example

You invoiced someone on 15 March 2021 but did not receive the money until 30 April 2021. Record this income for the 2021 to 2022 tax year.

Please be aware that whilst you can report to HMRC using the cash method if you require accounts for a mortgage or loan application the bank will only accept the traditional accounting method. You will find that most accountants will still prepare accounts on the traditional method for this purpose.

As well as the standard records, you’ll also need to keep further records so that your tax return includes:

- What you’re owed but have not received yet.

- What you’ve committed to spending but have not paid out yet, for example, you’ve received an invoice but have not paid it yet.

- The value of stock and work in progress at the end of your accounting period.

- Your year-end bank balances.

- How much you’ve invested in the business in the year.

- How much money you’ve taken out for your use.

Conclusion

Understanding to you can start keeping books for your small business is important. Unfortunately, it’s often seen as something that anyone can have a go at, which is true, but without knowing the important facets, you could get yourself into bother.

Getting your books for a small business wrong can be the difference between success and failure – it really s that important. There are many tools available to help you but just having the right gear is not enough on its own.

Running a small business is hard. We would fully advocate working with a professional bookkeeper or accountant to ensure that you maximise your chances of success.

Image in header via https://pixabay.com/photos/folder-briefcase-brown-blue-paper-385530/

Jon has been in business since 1999, and in that time worked with more than 300 small business clients. As well as being an accountant, he is also an early adopter of tech, and has helped small businesses to leverage the power of their computer systems by creating software to automate and simplify accounting tasks.