With rising costs it’s important to understand how VAT on import duty works, and whether you can claim it back. In this guide we will explain how VAT is calculated on imported goods, what you pay, and how to make an import duty VAT reclaim.

Getting it wrong could be the difference between making a profit or loss on the goods so it is vital to understand the process from start to finish.

We are sure you have better things to do than work through the fine detail to ensure you do not get your VAT confused with your customs duties. So, if you have ever been left scratching your head wondering ‘is there VAT on import duty?’ here’s a simple answer:

Import VAT is charged on all goods (except gifts worth £39 or less) sent from outside the UK to Great Britain and outside the UK and the EU to Northern Ireland. If you must pay VAT to the delivery company, it’s charged on the total package value including the value of the goods, postage, packaging, insurance, and any duty you owe. As such there is VAT on import duty.

There is a lot of ground to cover on the subject paying VAT on import duty, scroll down to read our ultimate guide to import VAT and customs duty. After reading it you should feel confident in claiming the right amount of taxes for your business.

What is import duty?

Before answering the question of whether there is VAT on import duty to pay or reclaim, we need to establish what import duty is.

There is no specific item called import duty. It is in fact made up of different taxes due on goods from abroad. Sorry to break it to you but the specific term of import duty is not even a thing.

What it does in fact relate to is:

Import VAT

VAT is charged on all goods (except gifts worth £39 or less) sent from outside the UK to Great Britain and outside the UK and the EU to Northern Ireland.

You pay VAT when you buy the goods or to the delivery company before you receive them.

If you must pay VAT to the delivery company, it’s charged on the total package value including the value of the goods, postage, packaging, insurance, and any duty you owe. VAT is charged at the VAT rate applicable to your goods.

Customs Duty

You’ll be charged Customs Duty on all goods sent from outside the UK (or the UK and the EU if you’re in Northern Ireland) if they are excise goods (see below) or worth more than £135.

If you are charged Customs Duty, you’ll need to pay it on both the price paid for the goods and the postage, packaging, and insurance.

Excise Duty

If you’re sent alcohol or tobacco from outside the UK, you’ll be charged Excise Duty. This is designed to limit the consumption of products that are seen to be damaging to the environment and consumers’ health. It also ensures the government gets the tax that had the product been bought in the UK they would have received. Otherwise, we would just import all our goods for a lower price.

Is import duty reclaimable?

Unlike VAT customs duty and excise duty cannot be reclaimed unless you have returned the goods or think you’ve been charged too much.

If you’re charged too much or return your goods:

Download and fill in:

- form BOR 286 if Royal Mail or Parcelforce delivered the goods

- form C285 if a courier or freight company delivered the goods

Is import duty the same as VAT?

No. Import duty is not the same as VAT. Import duty is a term encompassing both customs duty and excise duty which are types of tax payable on the value of imported goods whereas VAT is another type of tax which is payable by the end customer.

When goods come into the UK, and they cross the border various taxes may be payable. Duty and VAT are two of the most common types of tax payable but import duty is not the same as VAT they are two different types of tax.

Paying VAT on imports from outside the UK to Great Britain and from outside the EU to Northern Ireland you may have to pay import VAT on goods. This is where the confusion often lies in the use of similar terms import VAT and Import Duty. They may even be used interchangeably but they are different things.

Is there VAT on import duty?

Now that we have established that VAT and import duty are two separate items and types of taxes, we can consider whether you pay VAT on import duty.

VAT is charged on all goods (except gifts worth £39 or less) sent from outside the UK to Great Britain and outside the UK and the EU to Northern Ireland.

You pay VAT on import duty when you buy the goods or to the delivery company before you receive them. If you must pay VAT to the delivery company, it’s charged on the total package value including the value of the goods, postage, packaging, insurance, and any duty you owe.

VAT is charged at the VAT rate applicable to your goods.

On that basis then yes, there is VAT on import duty if the supply comes via a delivery company.

Can you claim VAT back on import duty?

You’ll be contacted by Royal Mail, Parcelforce, or the courier company if you need to pay any VAT, duty, or delivery charges (‘handling fees’) to receive your goods.

They’ll send you a bill stating exactly which fees you need to pay including import duty.

They’ll normally hold your parcel for about 3 weeks. If you have not paid the bill by then, your parcel will be returned to the sender.

You will not have to pay anything to the delivery company to receive goods worth less than £135 unless they’re gifts over £39 or excise goods (for example, alcohol and tobacco).

Using the documentation, you have received you can claim the VAT back as shown on the bill. You pay VAT to the delivery company, which is charged on the total package value including the value of the goods, postage, packaging, insurance, and any duty you owe.

After an import VAT payment is made by a UK VAT-registered trader, an HMRC form C79 showing the VAT paid will be electronically produced and sent to the business address.

This ‘Import VAT Certificate’ is then used as evidence of the VAT paid and can be included in your VAT return.

Handy Hint: We’ve recently published a guide on how VAT is applied to postage and delivery charges in the UK, including Royal Mail and stamps.

What VAT rate is import duty?

Imported goods are normally charged at the same rate as if they had been supplied in the UK. VAT is charged at the VAT rate applicable to your goods.

VAT-registered businesses can account for import VAT on their VAT Return by using postponed VAT accounting. Accounting for VAT on your VAT Return in this way allows you to declare import VAT and reclaim it as input tax on the same VAT Return.

You can reclaim the VAT incurred on the imported goods you own as input tax subject to the normal rules.

Alternatively, a business can choose to pay import VAT on importation. If you choose to do this, you can reclaim the VAT incurred on the imported goods you own as input tax subject to the normal rules.

To claim input tax, you will need the import VAT statement as evidence. A shipping or forwarding agent cannot usually reclaim this input tax because the goods were not imported to be used in part of their business.

Do you pay VAT twice on imports?

No, you don’t pay VAT twice on imports.

VAT is added to the total costs of the imported goods. Those imported goods may have been charged custom duty or excise duty before the calculation of VAT.

It might feel like you are paying VAT twice, but you are not as customs and excise duties are different to VAT. You are paying a type of tax twice, but you are not paying VAT twice on imports.

If you are a VAT-registered business, then you will be able to reclaim the VAT charged. Make sure you keep a copy of your C79 certificate as evidence.

FAQs about VAT on import duty

Is import duty exempt from VAT?

Based on what we now know, it’s clear that import duty is not exempt from VAT. As we discussed earlier, VAT is applied when you buy the goods or to the delivery company before you receive them.

If you must pay VAT to the delivery company, it’s charged on the total package value including the value of the goods, postage, packaging, insurance, and any duty you owe.

What is postponed VAT accounting?

Accounting for import VAT on your VAT Return has significant cash flow benefits and will be available permanently. It means you’ll declare and recover import VAT on the same VAT Return, rather than having to pay it upfront when the goods are imported and recover it later.

You do not need any approval to account for import VAT on your VAT Return.

If you get a person or business to import goods on your behalf (such as a freight forwarder, customs agent, broker, or fast parcel operator) you will need to tell them how you want to account for import VAT on those imports. This is so they can complete the import declaration.

If you already have someone you should contact them to tell them if you want to account for import VAT on your VAT Return on goods you import. You should keep a written record of what is agreed.

If you have selected that you are accounting for import VAT on your VAT Return on your import declaration you will need to account for import VAT when you complete your VAT Return.

How do I post import VAT in my bookkeeping software?

When you purchase goods from a country outside the UK, import VAT may be applied. Normally, your supplier invoice doesn’t contain any VAT, but a separate invoice is supplied from the import agent detailing any import VAT and duty they’ve paid on your behalf at customs.

If your company is registered for VAT, you can normally reclaim the import VAT provided you have supporting C79 certificates from HMRC.

Posting import VAT on Xero

There is a special tax rate in Xero for allowing you to post a bill that is 100% VAT. Posting import VAT on Xero is as simple as using the ‘VAT on imports’ tax rate.

You can use the VAT on Imports tax rate to record other types of payments you make that are VAT only. For example, if you need to pay the VAT portion of an insurance claim.

The amounts will show as VAT on Imports in Xero’s VAT return, but only the overall amount in box 4 is sent to HMRC.

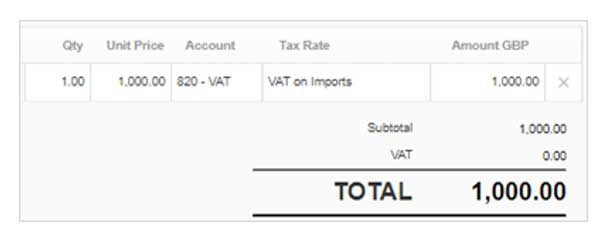

Create your transaction and enter the description and quantity details, then:

- In the Unit Price field enter the amount of VAT payable.

- In the Account field, select the VAT account. If you’re using the default chart of accounts, this is account 820.

- In the Tax Rate field, select the VAT on Imports tax rate.

Conclusion

If you are importing and/or exporting goods for your small business in the UK then you will know what a tricky subject VAT and duties can be. Many businesses will use a specialist company to deal with the reporting and payments involved in this process.

Anything posted or couriered to you from another country goes through customs to check it is not banned or restricted and to see you pay the right tax and ‘duty’ on it.

You must understand the process and in particular the accounting and tax implications to make sure you are paying and reclaiming the correct amount of tax your business is entitled to.

Which is why it’s important to understand VAT on import duty – there are no shortage of things to potentially trip you up and whether there is VAT on import duties is another prime example.

We are now well versed in knowing that import duty and VAT are two completely different things. VAT is the only portion of the costs of our imported goods that we can reclaim. Understanding the total costs of our imported goods is vital to know whether we are making a profit on these goods.

We need to make sure we have the correct evidence to reclaim VAT in the form of a C79 certificate and that we post the entries correctly in our accounting system, so we reclaim the VAT on our VAT return. There is no point in having the evidence of VAT without reclaiming it.

You’ll be amazed how many times we have seen this in the past!

If we are going to be importing lots of goods this could leave us at a cashflow disadvantage in which case, we may wish to look at opting for Postponed VAT accounting.

More small business owner advice…

Image in header from https://unsplash.com/photos/CpsTAUPoScw

Jon has been in business since 1999, and in that time worked with more than 300 small business clients. As well as being an accountant, he is also an early adopter of tech, and has helped small businesses to leverage the power of their computer systems by creating software to automate and simplify accounting tasks.