One of the biggest misconceptions when completing the bookkeeping for your small business is £0 VAT equals No VAT in QuickBooks. When using QuickBooks as your bookkeeping software you may be enticed to use the No VAT tax rate for all transactions that have no VAT.

That would be a sensible thing to do right?

Wrong.

There are multiple situations where £0 isn’t No VAT and a bunch of reasons when £0 is No VAT.

Are you still with me? I hope so, but even if you’re not, below I’ll explain exactly when you should use No VAT in QuickBooks and what No VAT in QuickBooks means.

When should I use No VAT in QuickBooks?

It’s not always obvious what the difference between No VAT in QuickBooks is versus zero-rated and exempt VAT. It’s probably not something you have ever thought too long and hard about because it all equates to the same thing – nothing being charged to the customer and nothing to reclaim on purchases.

I’m sure you have better things to do than try and understand the complexities of the UK tax system. So, if you have ever been left scratching your head wondering ‘when should I use No VAT in QuickBooks?’ here’s a simple answer:

Knowing when you should use No VAT in QuickBooks you need to understand what is outside the scope of VAT. Whilst many business transactions might have £0 VAT that is not the same as No VAT. Exempt items are different from zero-rated supplies which are different from outside the scope of VAT, yet they all mean £0 VAT from a monetary point of view.

I won’t go into detail about zero-rated VAT or exempt VAT in this article. If you wish to find out more on this subject, you can read ‘difference between zero-rated and exempt VAT’.

What VAT is?

Before deciding what is outside the scope of VAT, we first need to understand some of the basics such as what VAT is.

VAT is a tax on consumer expenditure. It’s collected on business transactions, imports, and acquisitions.

Most business transactions involve supplies of goods or services. VAT is payable if the supplies are made:

- in the UK or the Isle of Man

- by a taxable person

- in the course or furtherance of business

- that are not specifically exempted or zero-rated

Supplies which are made in the UK or the Isle of Man and which are not exempt are called taxable supplies.

A taxable person is an individual, firm, company and so on who is, or is required to be, registered for VAT. A person who makes taxable supplies above certain value limits is required to be registered. That threshold is currently £85,000 taxable turnover.

A person who makes taxable supplies below these limits can be registered in the UK on a voluntary basis if they wish, in order, for example, to recover VAT incurred in relation to these taxable supplies.

In addition, a person who is not registered for VAT in the UK but acquires goods from an EU member state into Northern Ireland, or makes distance sales in Northern Ireland from EU, above certain value limits may be required to register for VAT in the UK (and such persons may register voluntarily if their acquisitions or distance sales are below these limits).

Now that’s the boring bit out of the way. Let us move on to what is deemed outside the scope of VAT and when you should use the No VAT tax rate in QuickBooks.

What is outside the scope of VAT?

For the remainder of this article, we will refer to No VAT as being ‘outside the scope of VAT’.

Getting this wrong will not necessarily lead you to under or overpaying HMRC if the transactions are outside the scope of VAT but if you confuse them with zero-rated and exempt transactions it will mean your VAT returns submitted will be incorrect.

It is always best to double-check receipts and invoices for evidence of VAT and whether it is outside the scope, zero-rated VAT or exempt. This isn’t always easy as there are many exceptions to the rules when it comes to VAT and how it is displayed on receipts and invoices.

Getting this wrong could trigger an HMRC investigation as the numbers may not stack up on your VAT return.

The team at Croner have put together this excellent description of outside scope items.

Generally, the following are ‘outside the scope’ of UK VAT:

- transactions which do not involve making:

- a supply of goods or services (e.g. money received from an insurance claim concerning damage done to the premises during a burglary. The club did not provide any goods or services to the insurer),

- an importation into the UK, or

- an acquisition of goods from another member state (when the UK was still a member of the EU, or treated as still a member of the EU);

- supplies by a non-taxable person, e.g. a business person who is not liable to be VAT registered;

- supplies not in the course or furtherance of any business (a non-business activity such as a hobby);

- supplies of goods or services made outside the UK, but VAT may be payable in the country where the supply takes place, e.g. tour operators are often involved in supplies where the place of supply is outside the UK.

There is a more detailed explanation with examples on the Croner-i site.

To summarise for outside-the-scope transactions VAT doesn’t apply at all to these goods or services sold so you do not add VAT to your sales price and no VAT can be reclaimed on the purchase.

When should I use the No VAT tax rate in QuickBooks? When the transactions are outside the scope of VAT.

Examples of outside the scope of VAT goods and supplies

- Voluntary donations to charity

- Welfare services provided by charities at significantly below cost

- Tolls for bridges, tunnels and rods operated by public authorities

- Direct-mail postal services (VAT notice 700/24)

- Wages paid to employees

- Sales of vehicle MOTs

- Sales when you are not registered for VAT

- TFL congestion charge

- Personal sales

- Internal accounting adjustments via journal

- Purchases of goods or services from unregistered suppliers

This is not an exhaustive list which can be found in the HMRC rates of vat on different goods and services.

Please be sure to double-check with your accountant, bookkeeper, or the tax office if you are unsure what VAT tax rate you should be applying to your supplies.

Do not confuse outside the scope of VAT and zero-rated with exempt. Whilst they all may attract a £0 VAT charge, they are different. When entering your purchases into your accounting records make sure to use the No VAT, zero-rated or exempt tax rate as applicable.

Do outside the scope of VAT supplies go on a VAT return?

No.

Using the No VAT tax rate in QuickBooks will mean those transactions do not end up on a VAT return. When selecting No VAT as a tax code it should not be hitting any of the boxes at all.

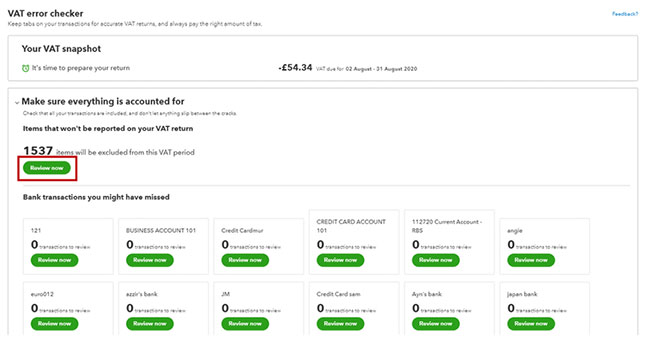

QuickBooks has a built-in VAT error checker giving accuracy, confidence, and time back to QuickBooks customers filing VAT.

One of the checks it will run is ‘items that won’t be reported on your VAT return’. This sub-section notifies you of any VAT transactions that will not be reported on your return. This is usually because you have set the transaction to No VAT instead of inclusive or exclusive of VAT. If you would like to review or edit these transactions, you can click on Review Now and make the necessary changes.

If you do not complete a VAT control account reconciliation and turnover reconciliation for each VAT submission you should consider doing so to ensure the accuracy of your returns being submitted to HMRC.

This is a process you would expect all good bookkeepers and accountants to do as part of the VAT return submission.

FAQs on No VAT in QuickBooks

How to find No VAT transactions in QuickBooks?

To find your No VAT transactions QuickBooks has a built-in VAT error checker giving accuracy, confidence, and time back to QuickBooks customers filing VAT.

One of the checks it will run is ‘items that won’t be reported on your VAT return’. This sub-section notifies you of any VAT transactions that will not be reported on your return. This is usually because you have set the transaction to No VAT instead of inclusive or exclusive of VAT. If you would like to review or edit these transactions, you can click on Review Now and make the necessary changes.

There is also a range of reports within QuickBooks you can run to find No VAT transactions in QuickBooks, however the one you will find most useful is the No VAT Transactions report.

You can customise the no VAT transactions report so that this only shows specific accounts (e.g. income only) – to do this, open the report and click customise > filter > distribution account > select ‘all income accounts’ or scroll and tick the accounts that you want to appear manually > run report.

This report customisation can then be saved so that you can run this again at a later point without having to make amendments (you’d have to create a separate report for No VAT income and No VAT expense). You can then export the reports and sum the amount column in Excel to create a total for each.

Do outside the scope of VAT sales count towards the VAT registration threshold?

As with exempt sales you should not add outside the scope of VAT sales to your turnover when determining if you need to register for VAT.

The current VAT registration threshold is £85,000 for taxable turnover.

Example

- Total turnover for your business: £150,000

- Exempt turnover: £30,000

- Outside scope sales: £50,000

- Taxable turnover: £70,000

You would not need to register for VAT. You would need to make sure you have a way of recording the different types of sales so you could prove this calculation and monitor it as the VAT registration is based on a rolling 12-month basis.

There might be valid reasons to register for VAT voluntarily and you can read more about them in our pros and cons of being VAT registered guide.

Should I use No VAT when posting journals in QuickBooks?

When posting journals in QuickBooks you are more than likely going to be creating entries that you will not want to record on a VAT return such as accruals, prepayments, and wages. The original transactions posted into your QuickBooks records should have the correct VAT treatment applied to them so do not adjust that.

It, therefore, makes sense when adjusting your accounting records for posted items to use the No VAT tax rate.

If you are using a journal to post a transaction into QuickBooks, then yes it would be correct to apply the correct VAT tax rate. An example might be that you enter expenses or petty cash via journal and there is VAT to reclaim.

Conclusion

So, there you have it. There are three different occasions where there may not be VAT charged on goods or services that carry different rates of VAT. It doesn’t mean there is ‘no VAT’ and it certainly doesn’t mean you should use the No VAT tax rate in QuickBooks for them all.

There is outside the scope of VAT, zero-rated and exempt.

The outside the scope of VAT purchases are the only items where you should use the No VAT tax rate in QuickBooks. These transactions do not get entered on a VAT return, so it is important to follow the correct rules to avoid triggering an HMRC investigation or paying your accountant obscene amounts of money at the end of the year to tidy up these errors. There are much better things to spend your money on.

When postings transactions that are zero-rated VAT or exempt these should be posted using the applicable tax rate, so they appear on your VAT in the relevant boxes.

Jon has been in business since 1999, and in that time worked with more than 300 small business clients. As well as being an accountant, he is also an early adopter of tech, and has helped small businesses to leverage the power of their computer systems by creating software to automate and simplify accounting tasks.