If you are running a small business, it’s a legal requirement to keep proper books and records for tax purposes. As a small business owner, what does keeping records for a small business mean?

For example, do you need to keep receipts for business expenses, and if so, what format should receipts be and how long do you need to keep business expense receipts for in the UK? This may lead you to ask yourself ‘what records do I need to keep for a small business?’.

What records do I need to keep for a small business? As a small business, you need to keep records of all sales and income, business expenses, VAT if you’re registered and PAYE if you employ people. That is not an exhaustive list of records you need to keep for a small business. How you keep records and for how long are also important factors.

The records you need to keep for a small business, the complexity, the amount of time to process and how important keeping good records for a small business is, cannot be underestimated.

This is normally something a small business will spend the least amount of time considering but every business decision you make impacts the administration and financial records of a business.

You must keep records of your business income and expenses for your tax return if you are self-employed.

You’ll need to choose an accounting method.

Most businesses use traditional accounting where you record income and expenses by the date you invoiced or were billed.

Example

You invoiced a customer on 28 March 2021. You record that invoice for the 2020 to 2021 tax year – even if you did not receive the money until the next tax year.

Most small businesses with an income of £150,000 or less can use cash basis reporting. With this method, you only record income or expenses when you receive money or pay a bill. This means you will not need to pay income tax on the money you have not yet received in your accounting period.

Example

You invoiced someone on 15 March 2021 but did not receive the money until 30 April 2021. Record this income for the 2021 to 2022 tax year.

Please be aware that whilst you can report to HMRC using the cash method if you require accounts for a mortgage or loan application the bank will only accept the traditional accounting method. You will find that most accountants will still prepare accounts on the traditional method for this purpose.

Self-employed record keeping

What records to keep

You’ll need to keep records of:

- all sales and income

- all business expenses

- VAT records if you’re registered for VAT

- PAYE records if you employ people

- records about your personal income

- your grants, if you claimed through the Self-Employment Income Support Scheme – check how much you were paid if you made a claim

Why you keep records

You do not need to send your records in when you submit your tax return but you need to keep them so you can:

- work out your profit or loss for your tax return

- show them to HM Revenue and Customs (HMRC) if asked

You must make sure your records are accurate.

Keep proof

Types of proof include:

- all receipts for goods and stock

- bank statements, chequebook stubs

- sales invoices, till rolls and bank slips

If you’re using traditional accounting

As well as the standard records, you’ll also need to keep further records so that your tax return includes:

- what you’re owed but have not received yet

- what you’ve committed to spend but have not paid out yet, for example, you’ve received an invoice but have not paid it yet

- the value of stock and work in progress at the end of your accounting period

- your year-end bank balances

- how much you’ve invested in the business in the year

- how much money you’ve taken out for your own use

How to start keeping books for a small business

Bookkeeping is the process of recording and reporting financial information. It is imperative to get your bookkeeping right to ensure you are reporting the correct profit and loss, calculate taxes and make sound business decisions based on accurate up to date data.

- Choose an accounting method – as discussed above you need to consider whether the cash or traditional method of accounting is right for your small business considering all the factors

- Set up a separate bank account – probably the single most important thing you can do. It is hard enough maintaining the business records let alone if you are mixing business and personal transactions

- Know your filing deadlines – there are multiple filing and reporting deadlines across the year for small businesses, if you factor in VAT and PAYE you could have as many as 30 filing requirements to be compliant. You need to get very organised.

- Keep records of every payment and receipt – you need to keep a log of all sales invoices raised and all bills received and when they were paid, reconciled back to your business bank account so you can track at any given point what you are owed and what you owe so you can manage your business cash flow.

- Keep track of expenses – every time you spend money from your own personal accounts there is a chance you will forget to claim it. Don’t. If you spend £120 from your own account and forget about it you have just lost £20 in VAT and £20 in income tax relief. Not to mention the fact that you would have paid tax and national insurance on that £120 before you received it. A forgetful memory can be a very costly thing.

- Access to online banking – you need to always have your finger on the pulse, and this means knowing what is coming in and out of your business bank account. Make sure you have access to online banking from day one.

- Raise sales invoices frequently – you will be amazed at just how many sales invoices don’t even get sent to a customer on account of the business owner being busy and forgetting. Do this exercise often. It will avoid forgetting, queries will be raised faster, you can act on non-payments faster and you will ultimately get cash into your account quicker.

- Choose suitable software – all the above sounds difficult and time-consuming. You would be right. The administration of a small business is disproportionate to the amount of time you spend doing your trade, but it is just as important. Make your life as simple as possible by getting the right piece of software for your small business. There are hundreds of solutions on the market so this can be quite tricky but worth it in the long run.

- Produce monthly reports – you need to know who owes you money, who you owe money to, what the performance of the business is what financial position you are in. This is not possible unless you start keeping books for your small business.

- Set time aside – keeping books for a small business is a time-consuming process even with the latest software. You need to plan this work in your diary, so it is done on a regular basis. Trying to squeeze it in between everything else will lead to mistakes which will cost you money.

Do I need to keep paper records for HMRC

There are no rules on how you must keep records. You can keep them on paper, digitally or as part of a software program (like book-keeping software).

HMRC can charge you a penalty if your records are not accurate, complete, and readable.

With the government’s digitisation of accounting records initiative, Making Tax Digital being phased in over several years the government’s preference is to have digitised records.

We advise that you keep all receipts and bills for business expenses, there are many excellent data capture tools on the market which integrate with the leading bookkeeping software, and this will let you maintain proper business records so you can:

- Work out your profit and loss for tax returns.

- Show them to HMRC should you be asked.

You must make sure your records are accurate. You, therefore, need to keep receipts for business expenses if in the UK to comply with these requirements. These are best kept in digital format, so they are easy to store and retrieve.

Don’t worry if you have lost a receipt, it is not the end of the world. These things happen. In fact, 65% of Senior Decision-makers in finance and accounting admit to losing receipts.

Try to get copies of as many as you can, for example, ask suppliers for duplicate invoices or receipts. Using your business bank account for making purchases will help with this as you will have an audit trail of what was spent and when.

You may have to pay interest and penalties if your figures turn out to be wrong and you have not paid enough tax.

If you are making a claim for expenses from an employer, you may find them less forgiving. It is not uncommon for a business’s travel and expenses policy to state that no reimbursement will be made without a valid receipt.

How long do I need to keep business records

For a limited company in the UK, you must keep expense receipts and records for 6 years from the end of the last company financial year they relate to, or longer if:

- They show a transaction that covers more than one of the company’s accounting periods.

- The company has bought something that it expects to last more than 6 years, like equipment or machinery.

- You sent your Company Tax Return late.

- HMRC has started a compliance check into your Company Tax Return.

For the self-employed it is slightly easier as you must keep expense receipt records for at least 5 years after the 31 January submission deadline of the relevant tax year. HM Revenue and Customs (HMRC) may check your records to make sure you’re paying the right amount of tax.

Example

If you sent your 2020 to 2021 tax return online by 31 January 2022, you must keep your expense receipt records until at least the end of January 2027.

Very late returns

If you send your tax return more than 4 years after the deadline, you’ll need to keep your records for 15 months after you send your tax return.

If you cannot replace your records, you must do your best to provide figures. Tell HMRC when you file your tax return if you’re using:

- Estimated figures – your best guess when you cannot provide the actual figures.

- Provisional figures – your temporary estimated figures while you wait for actual figures (you’ll also need to submit actual figures when available).

Can I use bank statements as receipts for taxes

A bank statement does not count as a receipt for taxes. It does act as evidence that a payment was made but it does not detail the actual items purchased. To offset purchases against your taxable income you need to be able to prove that the expense was wholly and exclusively for the course of the business.

Payment out of your business bank account will show the date, supplier and the amount that was paid but it does not act as a substitute when it comes to claiming the expense as a business cost.

This is the same when using a credit card or debit card voucher. The information contained on the voucher shows the payment details but not the actual items purchased and cannot, therefore, be used as evidence to claim VAT or business expense.

Example

You make a payment to Amazon for £150 from the business bank account in December. Without a valid VAT invoice, you would not be able to reclaim the VAT and you might also have difficulty convincing HMRC that it was wholly and exclusively for the business.

Self-employed accounts example

Creating a set of accounts can be a daunting task if you do not have the experience and knowledge. The information entered onto your self-assessment tax return is minimal so you may want to work from something a bit more detailed if you want accounts to make key business decisions.

The examples below are the standard and levels you would expect to receive from a qualified accountant.

If you have not sat your accountancy qualifications it is highly unlikely you will be able to put something of this nature together. These have been compiled using accounting software and a qualified accountant.

Please use this as a guide to what can be achieved but not necessarily something you should be striving towards.

If you are using bookkeeping software, such as QuickBooks Online or Xero, you will find that the information required to complete the self-employment pages of your self-assessment return should be available for you in the profit and loss report and the balance sheet report.

Depending on the complexity of your business we would recommend the use of a professional such as an accountant. Check out our guide on can a small business do their own taxes to see if working with an accountant would be beneficial.

Self-employed accounts template

If you would like to create a set of accounts for your self-employed business and you are not using an accountant or software that can provide this information, then you may find this a little difficult.

At the heart of preparing a set of accounts is great bookkeeping. To do this, you will need to be using some form of bookkeeping solution whether that be Excel or an online bookkeeping solution.

There are hundreds on the market including Xero and Quickbooks.

Most if not all these solutions will have a reporting functionality that should consist of a profit and loss report and a balance sheet report. These form the basis of any set of accounts.

Our advice would be to make sure that whatever bookkeeping solution you use that you check it also covers your reporting requirements and you are going to be able to produce a very simple set of accounts from a few key reports.

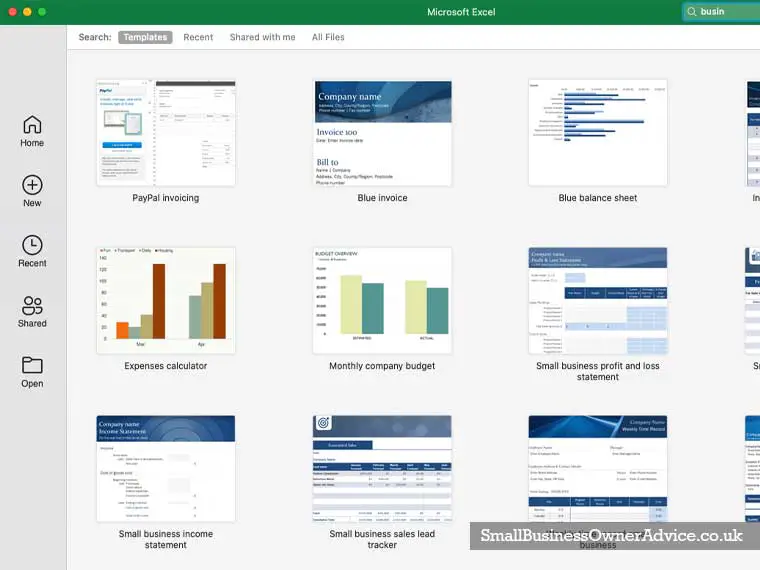

If you are going to use Excel to create your self-employed accounts template then we would suggest using the templates that already exist. When creating a new document use the search templates function to find a host of business templates.

Perhaps you should be looking to work with an accountant. Check out our guide on how much does an accountant cost for small business to get an idea of costs.

What can I use as proof of self-employment?

You can get evidence of your earnings (SA302) for the last 4 years once you’ve sent your self-assessment tax return.

You can also get a tax year overview for any year.

You might be asked for these documents as evidence of your income, for example, if you’re applying for a mortgage and you’re self-employed.

You can print your own tax calculation and tax year overview if you do your Self-Assessment tax return using either:

- HM Revenue and Customs’ (HMRC’s) online services

- commercial software

If you or your accountant use commercial software to do your return, you’ll need to use that software to print your tax calculation. It might be called something different in the software – for example ‘tax computation’.

You can still print a tax year overview from your HMRC online account.

Check that your mortgage provider accepts documents you’ve printed yourself. Some do not even though HMRC guidance has been they should accept this format to reduce the burden on their resources with so many people phoning and requesting SA302s.

If you have not completed your first year of self-employment or filed a tax return then you may have to use an alternative way to prove you are self-employed. Here is a list of what can I use as proof of self-employment:

- UTR

- Bank Statements

- Accounts

- HMRC correspondence

- Tax and National Insurance documents

- copies or printouts of Self-Assessment tax returns (SA100) for the relevant period and evidence that they have been received by HMRC

- statements of account (SA300) or tax calculations (SA302) issued by HMRC

- receipts or other written confirmation issued by HMRC of relevant taxes paid

- stamped receipts showing payment of class 2 National Insurance contributions during the relevant period

- evidence from your bank statements showing payment of National Insurance contributions if paid by BACS, CHAPs, online or telephone

FAQs on the records you need to keep for a small business

What records does a self-employed person need to keep?

As a self-employed person you will need to keep the following records in relation to each sole trade you are operating:

- all sales and income

- all business expenses

- VAT records if you’re registered for VAT

- PAYE records if you employ people

- records about your personal income

- your grants, if you claimed through the Self-Employment Income Support Scheme – check how much you were paid if you made a claim

You will also need to keep any P60s in relation to any paid employment, and details of any other earned income that is neither employment income or sole trade income. If you have rental properties for example you will need to keep accounts of income and expenditure for them.

All these different income streams and any expenses will be needed for your self-assessment tax return.

How do small businesses keep detailed records?

Hire a professional. The only way a small business keeps detailed and accurate records is if they have someone controlling the administration and financial transactions of the business. This cannot be treated as an afterthought in your small business. The process, procedures and systems required to capture all the different transaction types need to be embedded in the business.

How do small businesses keep detailed records? They understand the importance of having the right people looking after this task, they process transactions in a timely fashion, and they have a reporting and feedback loop that means people are held accountable.

That may sound like a lot for a small business which it can be. That is where using the right bookkeeping software and using the knowledge of a trained professional such as a bookkeeper or accountant could be the best decision you make.

What records should I keep as a sole trader?

As a sole trader you will need to keep the following records:

- all sales and income

- all business expenses

- VAT records if you’re registered for VAT

- PAYE records if you employ people

- records about your personal income

- your grants, if you claimed through the Self-Employment Income Support Scheme – check how much you were paid if you made a claim

Conclusion

Running a small business is a lot more complex than most would want to acknowledge. There are so many rules and regulations (not to mention exceptions to the rules) that you as a small business owner are supposed to know. Ignorance is not a form of defence when it comes to HMRC.

You probably did not set up in business to become a bookkeeper or accountant but that is where you can end up very quickly if you want to do a proper job which we would highly recommend you do.

According to a report from Starling the average micro-business spends 15 hours per week or 19% of their time doing financial admin tasks. Have you factored into your plans spending 10 weeks a year doing financial admin?

Whilst there is a cost to paying an external resource such as a bookkeeper or accountant to manage this on your behalf, there is a also a cost to doing it yourself.

That hidden cost may in fact be much higher than paying an expert. It is worth careful consideration before you enter the rabbit hole that if financial admin for a small business owner.

You might also like…

Image in header via https://pixabay.com/photos/documents-files-irat-file-dossier-3816835/

Jon has been in business since 1999, and in that time worked with more than 300 small business clients. As well as being an accountant, he is also an early adopter of tech, and has helped small businesses to leverage the power of their computer systems by creating software to automate and simplify accounting tasks.