One of the biggest misconceptions when completing the bookkeeping for your small business is £0 VAT equals ‘No VAT’ in Xero. When using Xero as your bookkeeping software you could be enticed to use the No VAT tax rate for all transactions that have no VAT.

That would be a sensible thing to do right?

Wrong.

There are multiple situations where £0 isn’t No VAT and a bunch of reasons when £0 is No VAT.

Are you still with me? I hope so, but even if you’re not, below I’ll explain exactly when you should use No VAT in Xero and what No VAT in Xero means.

When should I use No Vat in Xero?

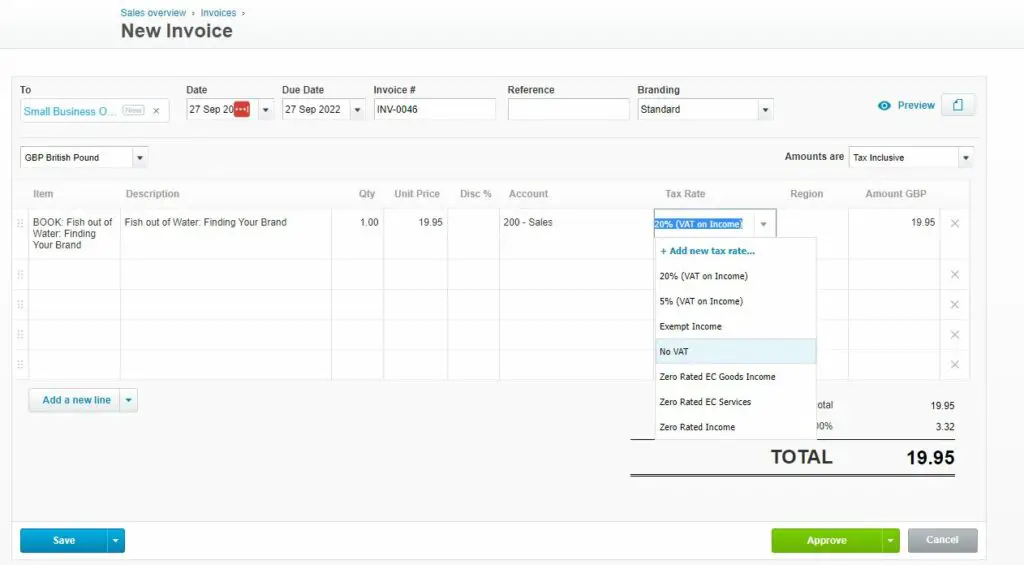

It’s not always obvious what the difference between No VAT in Xero is versus zero-rated and exempt VAT. It’s probably not something you have ever thought too long and hard about because it all equates to the same thing – nothing is being charged to the customer and nothing to reclaim on purchases.

I’m sure you have better things to do than try and understand the complexities of the UK tax system. So, if you have ever been left scratching your head wondering ‘when should I use No VAT in Xero?’ here’s a simple answer:

Whilst many business transactions might have £0 VAT that is not the same as No VAT. Exempt items are different from zero-rated supplies which are different from outside the scope of VAT yet they all mean £0 VAT from a monetary point of view. In order to know when you should use No VAT in Xero you need to understand what is outside the scope of VAT.

I won’t go into detail about zero-rated VAT or exempt VAT in this article. If you wish to find out more on this subject, you can read this guide on the differences.

What VAT is?

Before deciding what is outside the scope of VAT to use No VAT in Xero correctly, we first need to understand some of the basics such as what VAT is.

VAT is a tax on consumer expenditure. It’s collected on business transactions, imports, and acquisitions.

Most business transactions involve supplies of goods or services. VAT is payable if the supplies are made:

- in the UK or the Isle of Man

- by a taxable person

- in the course or furtherance of business

- that are not specifically exempted or zero-rated

Supplies which are made in the UK or the Isle of Man and which are not exempt are called taxable supplies.

A taxable person is an individual, firm, company and so on who is, or is required to be, registered for VAT. A person who makes taxable supplies above certain value limits is required to be registered. That threshold is currently £85,000 taxable turnover.

A person who makes taxable supplies below these limits can be registered in the UK on a voluntary basis if they wish, in order, for example, to recover VAT incurred in relation to these taxable supplies.

In addition, a person who is not registered for VAT in the UK but acquires goods from an EU member state into Northern Ireland, or makes distance sales in Northern Ireland from EU, above certain value limits may be required to register for VAT in the UK (and such persons may register voluntarily if their acquisitions or distance sales are below these limits).

Now that’s the boring bit out of the way. Let us move on to what is deemed outside the scope of VAT and when you should use No VAT tax rate in Xero.

What is outside the scope of VAT?

For the remainder of this article, we will refer to No VAT as being ‘outside the scope of VAT’.

Getting this wrong will not necessarily lead you to under or overpaying HMRC if the transactions are outside the scope of VAT but if you confuse them with zero-rated and exempt transactions it will mean your VAT returns submitted will be incorrect.

It is always best to double-check receipts and invoices for evidence of VAT and whether it is outside the scope, zero-rated VAT or exempt.

This isn’t always easy as there are many exceptions to the rules when it comes to VAT and how it is displayed on receipts and invoices.

Getting this wrong could trigger an HMRC investigation as the numbers may not stack up on your VAT return.

The team at Croner have put together this excellent description of outside scope items.

Generally, the following are ‘outside the scope’ of UK VAT:

- transactions which do not involve making:

- a supply of goods or services (e.g. money received from an insurance claim concerning damage done to the premises during a burglary. The club did not provide any goods or services to the insurer),

- an importation into the UK, or

- an acquisition of goods from another member state (when the UK was still a member of the EU, or treated as still a member of the EU);

- supplies by a non-taxable person, e.g. a business person who is not liable to be VAT registered;

- supplies not in the course or furtherance of any business (a non-business activity such as a hobby);

- supplies of goods or services made outside the UK, but VAT may be payable in the country where the supply takes place, e.g. tour operators are often involved in supplies where the place of supply is outside the UK.

There is a more detailed explanation with examples on the Croner-i site.

To summarise for outside-the-scope transactions VAT doesn’t apply at all to these goods or services sold so you do not add VAT to your sales price and no VAT can be reclaimed on the purchase.

When should I use the No VAT tax rate in Xero? When the transactions are outside the scope of VAT.

Examples of outside the scope of VAT goods and supplies

- Voluntary donations to charity

- Welfare services provided by charities at significantly below cost

- Tolls for bridges, tunnels and rods operated by public authorities

- Direct-mail postal services (VAT notice 700/24)

- Wages paid to employees

- Sales of vehicle MOTs

- Sales when you are not registered for VAT

- TFL congestion charge

- Personal sales

- Internal accounting adjustments via journal

- Purchases of goods or services from unregistered suppliers

This is not an exhaustive list which can be found in the HMRC rates of vat on different goods and services.

Please be sure to double-check with your accountant, bookkeeper, or the tax office if you are unsure what VAT tax rate you should be applying to your supplies.

Do not confuse outside the scope of VAT and zero-rated with exempt. Whilst they all may attract a £0 VAT charge, they are different. When entering your purchases into your accounting records make sure to use the No VAT in Xero, or instead zero-rated or exempt tax rate as applicable.

Do outside the scope of VAT supplies go on a VAT return?

No.

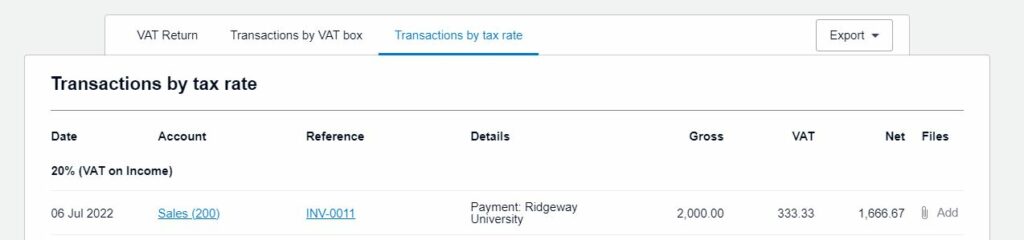

Using the No VAT tax rate in Xero will mean those transactions do not end up on a VAT return. You will see the transactions on your VAT return reports. On the Transactions by tax rate tab when looking at your VAT return reports it details all transactions for your VAT period listed by the different tax rates. On this tab you will find the No VAT transactions.

This is a good opportunity for you to review the No VAT transactions for completeness and accuracy. Anything that does not look right should be investigated and adjusted.

Whilst you will see the No VAT transactions on your VAT return report for transactions by tax rate do not confuse this with them being included in your VAT return box 1 to 9 figures. If you were to check the transactions by VAT box tab you will notice this reports on the transactions that make up each of your boxes on the VAT return. There will be no sign of a No VAT transaction.

If you do not complete a VAT control account reconciliation and turnover reconciliation for each VAT submission you should consider doing so to ensure the accuracy of your returns being submitted to HMRC.

This is a process you would expect all good bookkeeper and accountants to do as part of the VAT return submission.

FAQs on when you should use No VAT in Xero

How to find No VAT transactions in Xero?

There are a number of ways you can find No VAT transactions in Xero. The most obvious being the VAT return report on the transactions by tax rate tab. This is the easiest way as it will document all of the transactions for a period. This can be exported to Excel for further analyse.

If you would like to report on something other than a VAT period or perhaps just a certain type of transaction you will need to try a different route. This is where the Account Transactions report will help you find No VAT transactions in Xero.

The account transactions report in Xero is fantastic as you can slice and dice your data how you need it. In the report above I have chosen a date range and grouped my transactions by the VAT rate name which is No VAT. I have set the filter to only show transactions posted using the No VAT tax rate and am looking at all transaction types.

If I was looking for something in particular I could use the filter option and look at the source type as a way to really drill down.

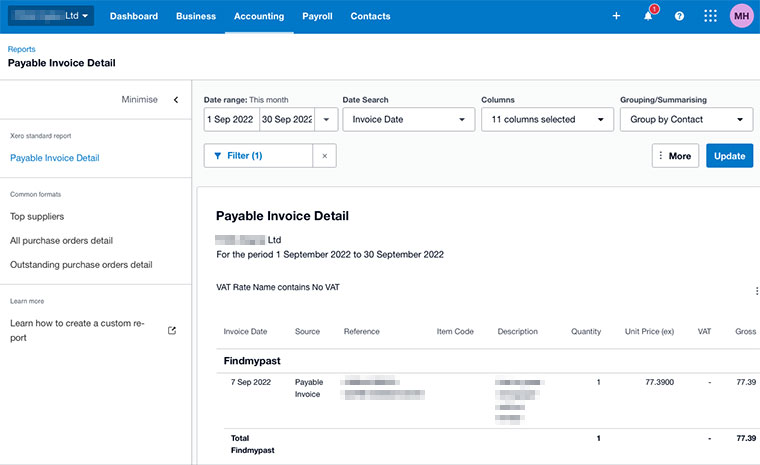

If you are looking for something a little more specific such as what outstanding sales or purchases have No VAT you can try the following. To find your No VAT transactions for purchases in Xero, go into the “reports’ section and select the “Payable Invoice Detail”. You can then select the “No VAT” filter which can be found under the “VAT Rate Name” drop down.

This will then produce a report showing transactions using the “No VAT” tax rate.

You can do something similar for your sales in Xero by using the “Receivable Invoice Detail”.

Do outside the scope of VAT sales count towards the VAT registration threshold?

As with exempt sales you should not add outside the scope of VAT sales to your turnover when determining if you need to register for VAT.

The current VAT registration threshold is £85,000 for taxable turnover.

Example

- Total turnover for your business: £150,000

- Exempt turnover: £30,000

- Outside scope sales: £50,000

- Taxable turnover: £70,000

You would not need to register for VAT. You would need to make sure you have a way of recording the different types of sales so you could prove this calculation and monitor it as the VAT registration is based on a rolling 12-month basis.

There might be valid reasons to register for VAT voluntarily and you can read more about them in our pros and cons of being VAT registered guide.

Should I use No VAT when posting journals in Xero?

When posting journals in Xero you are more than likely going to be creating entries that you will not want to record on a VAT return such as accruals, prepayments, and wages. The original transactions posted into your Xero records such as invoices and bills should have the correct VAT treatment applied to them.

If you are using a journal to post a transaction into Xero, then yes it would be correct to apply the correct VAT tax rate. An example might be that you enter expenses or petty cash via journal and there is VAT to reclaim.

If you are purely moving transactions from one account code to another or to adjust the costs into the right period such as inventory, accruals or prepayments then No VAT would likely be the correct option.

If these terms and concepts are not familiar to you then seek help from your bookkeeper or accountant before posting any journals.

Conclusion

So, there you have it. There are three different occasions where there may not be VAT charged on goods or services that carry different rates of VAT. It doesn’t mean there is ‘no VAT’ and it certainly doesn’t mean you should use the No VAT tax rate in Xero for them all.

There is outside the scope of VAT, zero-rated and exempt.

The outside the scope of VAT purchases are the only items where you should use the No VAT tax rate in Xero.

These transactions do not get entered on a VAT return, so it is important to follow the correct rules to avoid triggering an HMRC investigation or paying your accountant obscene amounts of money at the end of the year to tidy up these errors. There are much better things to spend your money on.

When postings transactions that are zero-rated VAT or exempt these should be posted using the applicable tax rate, so they appear on your VAT in the relevant boxes.

More small business owner guides…

Jon has been in business since 1999, and in that time worked with more than 300 small business clients. As well as being an accountant, he is also an early adopter of tech, and has helped small businesses to leverage the power of their computer systems by creating software to automate and simplify accounting tasks.