In the field of accounting, professionals often progress through various stages of qualification. It takes years of exams and professional experience to be become a fully qualified accountant. One such stage is being a part-qualified accountant.

This article aims to provide insights into the role and responsibilities of a part-qualified accountant, the equivalent qualification of ACCA (Association of Chartered Certified Accountants), salary expectations, and the number of exams required to achieve this status.

So, if you have been left confused by the different terminology about accountancy qualifications and in particular ‘what is a part-qualified accountant?’ here’s the simple answer:

A part qualified accountant is someone who has passed more than one exam in their chosen qualification but has not yet sat and passed the ‘final’ exams. With some professional bodies you also need to achieve 3 years of practical work experience to be considered a qualified accountant. Until you have passed all exams and have your practical experience signed off you will be considered a part-qualified accountant.

So, the short answer is a part-qualified accountant is someone who has started completing exams in a recognised accountancy qualification but has not completed all exams. The number and type of exams plus the practical experience required to gain full professional status will vary depending on the professional body. We have covered various scenarios below to help you understand what a part-qualified accountant is.

What is the role of a part-qualified accountant?

A part-qualified accountant is an individual who has completed some but not all the necessary exams and practical experience required to attain full professional qualification. Part-qualified accountants typically work under the supervision of fully qualified accountants and assist in tasks related to:

- statutory accounts

- corporation tax preparation

- personal tax preparation

- VAT returns

- company secretarial duties

- onboarding new clients

- acting as main point of contact for clients

- supervision of junior team members

- financial analysis

- reporting

- budgeting

- other accounting functions

Did you know? It is not too late to get into accounting at 30 and beyond.

What is the ACCA part-qualified equivalent to?

ACCA (Association of Chartered Certified Accountants) is a globally recognised accounting qualification. Being ACCA part-qualified indicates that an individual has completed some of the ACCA exams but has not yet achieved the full ACCA qualification.

It is difficult to say what ACCA part-qualified is equivalent to another qualification as there are several qualifications you can take to gain an accountancy qualification. There is no industry recognised list of what the most prestigious qualification is.

Different accountancy designations and qualifications are there to make sure the student gets the best overall experience and knowledge for the type of work they would be undertaking.

For example, ICEAW (ACA) would possibly be seen as the best route for a student looking to work in a general practice. The ACCA might be seen as the typical option for an accountant looking to work in industry so the internal accountant for a business. Whereas CIMA is a better fit for accountants looking to specialise in the field of Management Accounting.

What is the salary of a part-qualified accountant?

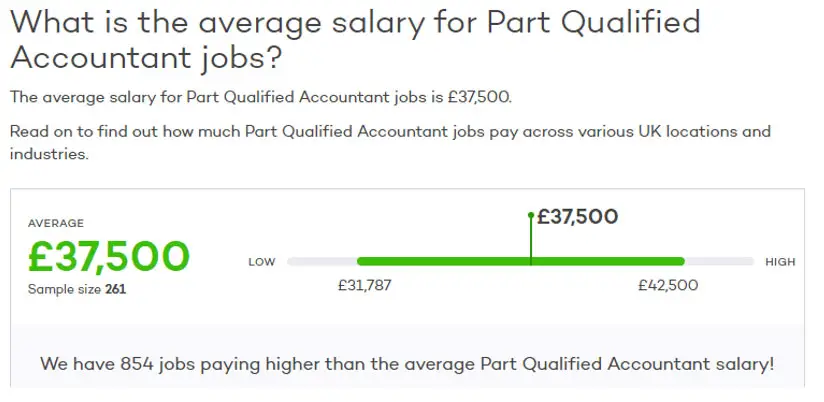

The salary of a part-qualified accountant can vary depending on factors such as location, industry, experience, and the level of responsibility. On average, part-qualified accountants can expect a competitive salary that reflects their qualifications and the value they bring to an organisation. Salaries typically increase as individuals progress towards full qualification and gain more experience.

What does a part-qualified accountant earn?

Listed on Totaljobs today (23rd July 2023) there are 864 jobs with an average salary of £37,500. Not bad for someone who hasn’t finished their training yet!

Currently there is a huge demand for accountants as there is a big talent gap in the market. This puts candidates and part-qualified accountants in a strong position to command top salaries higher than the market has seen before.

Check out how much an accountant costs a small business to give you an idea of how in demand you might be.

How many exams do you need to be a part-qualified accountant?

The number of exams required to become a part-qualified accountant depends on the specific accounting qualification pursued. For example, with the ACCA qualification, candidates need to complete 13 exams in total. However, the number of exams completed may vary based on exemptions granted for prior qualifications or experience.

The number and frequency of exams a part-qualified accountant will need to take might be a consideration when deciding which accountancy qualification to pursue. Whilst you may have to complete 13 exams for ACCA there are two sittings per year, and you can sit 4 papers at one sitting. Theoretically you could be finished in two years but that would be a massive endeavour as these papers are not easy.

You may be able to get exemptions from some papers if you have previously completed another qualification to lighten the load.

Even if you could finish the exams within a two-year time slot you would still need to wait to get the full designatory letters after your name as you need to complete 3 years practical work experience to gain the ACCA qualification.

FAQs on becoming a part-qualified accountant

When are you considered part-qualified ACCA?

To be considered part-qualified ACCA, candidates need to have successfully completed some of the ACCA exams but have not yet completed all the required exams for the full ACCA qualification. The specific exams completed will determine the stage of part-qualification.

Is AAT part-qualified considered an accountant?

AAT (Association of Accounting Technicians) is an entry-level qualification that provides a solid foundation in accounting principles and practices. While being AAT part-qualified demonstrates competence in basic accounting knowledge and skills, it is not typically considered equivalent to being a fully qualified accountant.

Further progression through higher-level qualifications, such as ACCA or CIMA (Chartered Institute of Management Accountants), is often pursued to achieve the status of a fully qualified accountant.

What is meant by being part-qualified?

Being part-qualified means that an individual has achieved a certain level of qualification or completed a portion of the required exams and practical experience to attain full professional qualification. Part-qualified professionals possess a combination of theoretical knowledge and practical skills, which allows them to contribute to accounting functions under supervision.

How many exams are required to become ACCA part-qualified?

To become ACCA qualified, candidates typically need to complete a total of 13 exams. However, the actual number of exams completed may vary based on exemptions granted for prior qualifications or experience. To be considered ACCA part-qualified you will have typically not completed all 13 exams. It is important to note that practical experience requirements must also be fulfilled to attain full ACCA qualification.

Conclusion

Being a part-qualified accountant signifies progress towards full professional qualification in the accounting field. Part-qualified accountants support the work of fully qualified professionals, contributing to various accounting tasks. The number of exams required to become part-qualified depends on the specific qualification pursued, such as ACCA, while salaries for part-qualified accountants can vary based on factors like experience and industry.

While AAT part-qualification is a solid foundation, further qualifications like ACCA are typically pursued to achieve the status of a fully qualified accountant. As part-qualified accountants continue their journey towards qualification, they gain valuable experience and expertise, enhancing their career prospects in the accounting profession.

The road to becoming a qualified accountant is a long and difficult one not for the faint hearted. For those that do make it the rewards are fantastic career prospects, transferable skills, a competitive salary and the opportunity to make a tangible positive impact on small business owners and their employees.

Jon has been in business since 1999, and in that time worked with more than 300 small business clients. As well as being an accountant, he is also an early adopter of tech, and has helped small businesses to leverage the power of their computer systems by creating software to automate and simplify accounting tasks.